According to a recent survey, only 1/3 of the U.S. population knows what 529 plans are. With national student debt surpassing $1.5 trillion and impacting 44 million Americans, a tax-advantaged college savings plan that grows a lot faster than a regular savings account sounds like a best-kept secret, right?

While there are pros and cons to starting a 529 plan, the general consensus is that they are a smart way to save for your child’s educational future. We’re here to cover the who, what, when, and how of 529 plans through the eyes of financial experts, parents who have started 529 plans, and kids who grew up to use them.

See also: The Pros and Cons of Using a 529 Plan to Save for College

What is a 529 plan and how can you use one?

Let’s get this out of the way—no judgement. A 529 plan is a tax-advantaged education savings plan, meaning there are tax advantages to using one, similar to a Roth IRA. The biggest benefit is that a 529 plan lets your money grow tax-free and be withdrawn tax-free if used for educational purposes. They can be sponsored by states, state agencies, or educational institutions, state governments being the most common.

Most people use their 529 accounts for college, but some plans can now be used for K-12 expenses. Here’s the catch: money can only be withdrawn for qualified education expenses, which depend on the plan type. If money withdrawn is not used for this purpose, you will be charged a 10 percent penalty fee plus ordinary income tax on the earnings. This does not offer enough flexibility for some families, but factors like number of children, perceived education expenses, and income level can determine whether or not a 529 plan is right for you.

Who should get one?

Since 529 plans are education savings plans, the person who starts a plan would be looking to benefit a child or teen in their educational future, i.e. parents or grandparents. A parent or grandparent can put away money tax-free to save for various elements of a child’s education.

“We wanted to do our due diligence and start from the very beginning. We knew that we wanted to support our children in college. My husband had to put himself fully through [college] and that was really hard. It was a lot, so we wanted things to be different for our children and when they were born we just started saving.” said Julie Leppek, a parent owner of an education savings 529 plan.

The jargon of finances, potential risk of investments, and having a seperate account you’re trying to put money into can seem overwhelming. These are factors that deter parents from setting up 529 plans, but Julie assured it was not only a “super easy process,” but that she was “pleasantly surprised” by the growth and ease of the investment.

“I think the bigger impact is its saved me from loans, but it’s definitely shaped how I’d save for my kids for college,” said Jake Leppek, Julie’s son, who is in his final year at California Polytechnic State University. “The idea of having an account is an appealing idea to me. Seeing the help that my parents have given me in college, I would absolutely give that to my child.”

The owner of a 529 account is commonly the contributor. While the owner depends on who is willing to be responsible for the account, Grant Glenn, Co-owner of Noble Wealth Partners and Individual Wealth Strategist, recommends focusing on ownership.

“I think that the most important thing is — pay attention to the ownership of the 529,” said Glenn. “Commonly, the financial advisors will want that under the ownership of the grandparent for FAFSA purposes.”

Under FAFSA, a parent-owned 529 plan adds 5.64 percent of the plan’s value to the Expected Family Contribution (EFC) calculation, while a 529 plan owned by a grandparent does not increase EFC until withdrawn.

Types of plans

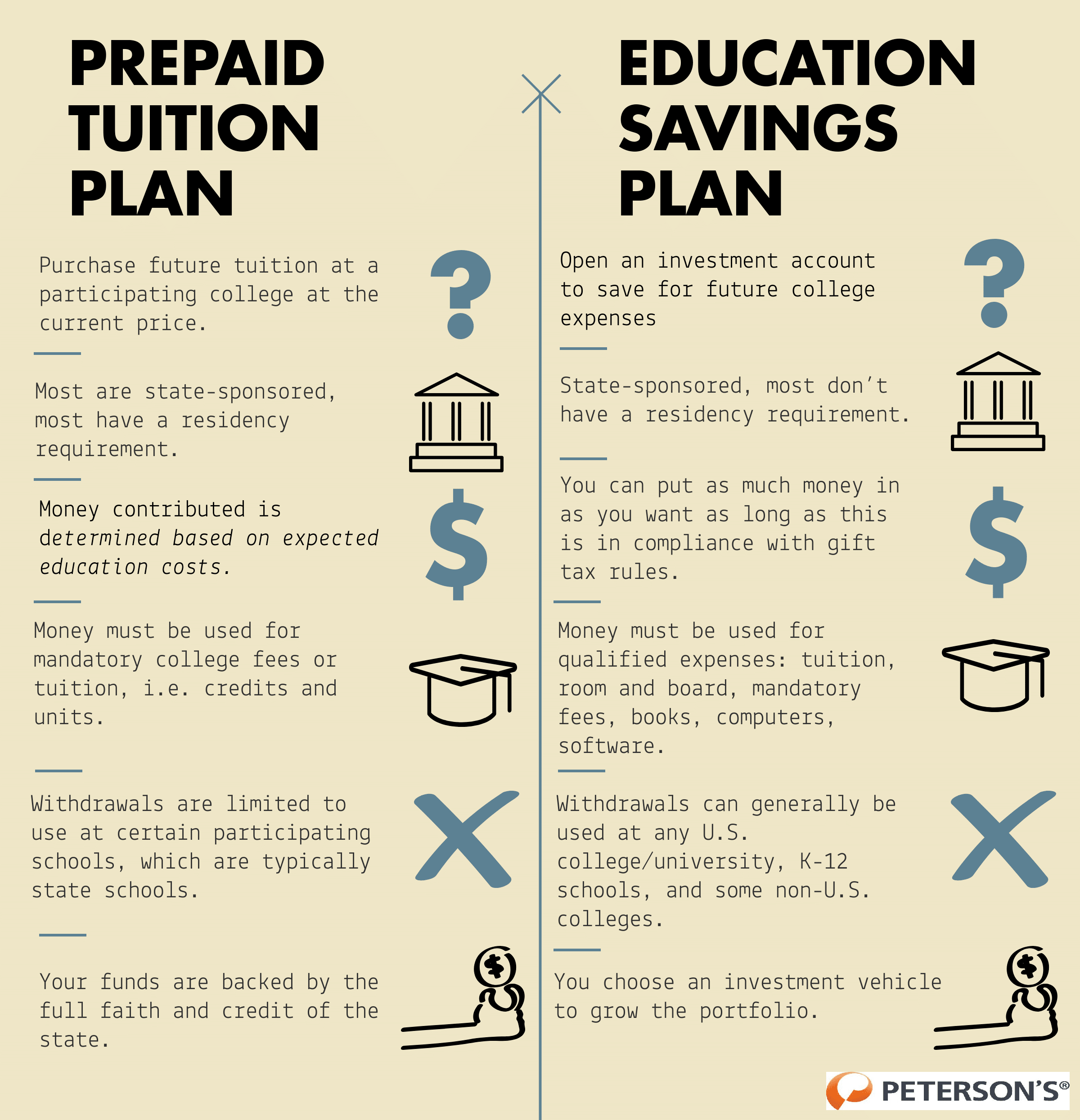

Important to note is that not all 529 plans are created equal. There are two main “types” of plans: a prepaid tuition plan and an education savings plan, and multiple variations of these plans at the state levels. Here’s a breakdown of the two:

Aside from the differences between these two types of plans, each state has their own variations of these plans. Check your state government website, or the site of the state where you would like to open the account for plan options.

Funding 529 plans

Of course, everyone’s available money for investments is different, and there are multiple ways to fund a 529 plan as they pertain to your financial situation.

“If you can put in around $3,000 a year over 18 years, you’ve got a good egg,” said Julie.

While that may not be feasible for everyone, due to the higher rate of return on investment than a standard savings account, putting any set amount of money per year available to you is very likely to increase the money you will have available to send your kids to college.

“I think people have to talk when they’re planning their families what kind of education they perceive supporting their kids with,” said Julie, who highly recommends starting a plan as early as possible, regardless of how much money parents are able to put into the account.

Glenn explained that if parents don’t believe a 529 plan is right for them, a Roth IRA may be an alternative education savings plan. While the accounts do not have state tax-deductions, they are more flexible in that they can be used in retirement.

Either way, finding a savings plan that works for you and your family makes the expensive task of sending kids to college easier.

“There are so many expenses associated with college, it’s not just a cut and dry number,” Julie said. In reference to savings plans, she believes “it’s the best way to have a stress-free college experience.”

With both parents and their children in agreement of the advantages, 529 plans or other appropriate education savings plans are the way to go.

“Assuming your kids are going to college I think it’s the only way to do it. The benefits are clear to see. It’s been a blessing as far as not having to worry about expenses in college,” said Jake.