Hearing the word FAFSA everywhere you turn in your high school halls? You may be utterly confused by what the thing is, or have heard horror stories from your parents about a big thick packet asking questions about which you don’t have the answers. This article will guide you through the process of understanding what the FAFSA is, how and when to fill it out. We also hope to calm your nerves around the form.

We talked to Elaine Griffin, who is the Senior Contributor and Communications Specialist for Edvisors. Griffin formerly worked for the U.S. Department of Education and her latest project was working on Edvisor’s 2019-2020 Guide to Filing the FAFSA®, so she knows a thing or two about this behaamouth application.. Griffin offered background and advice for the application process.

What is the FAFSA?

The name in itself is somewhat explanatory, as FAFSA stands for Free Application for Federal Student Aid. But, essentially, the FAFSA is an application you need to fill out in order to be eligible for federal student aid, like federal grants, work-study, and loans, as well as some states and colleges.

“The FAFSA is one of the most important if not the most important applications for financial aid for students of the United States attending U.S. universities. It will allow students to basically fill out one application, and it awards them the federal funded student aid that’s available to them based on the information provided in there,” said Griffin, who added that it also “goes a step further because the FAFSA is also used by states and institutions to further assist in awarding financial aid to those students through their state and institutional programs, so it’s a very important application.”

How does the FAFSA apply to you?

You may hear that some of your peers are choosing not to fill it out because they don’t think they’ll get anything out of it. However, Griffin recommends that also students fill out the FAFSA.

“There is a myth out there that financial aid is only for need-based purposes, and that’s not true, said Griffin. “There are some non need-based programs available. So, you don’t have to accept anything that you’re awarded, but it’s always good to see what your options are in all of them if you do need additional assistance, especially if you don’t think you’ll qualify.”

While you may not think you’ll qualify for need-based financial aid, you may need to take out student loans. As student debt continues to rise, it’s especially important to understand the federal student loan options.

“That federal student loan, it’s got some great benefits to it that you’re just not going to find in the private market,” said Griffin.

These other benefits may include subsidized loan options, Stafford loans, direct loans, fixed interest rates, and payments that aren’t due until after you graduate. Most also don’t require a credit check.

There are also other specific loan types with benefits can help minimize your debt and interest.

Then, on the specific school and state side of things, there are various criteria that students can qualify for to receive other types of aid.

“It’s never a bad idea to just try and see if there’s any programs that the student could possibly qualify for, that maybe have some other income brackets. That’s going to vary a little bit more, but there is a chance that there are other types of aid that the student can qualify for outside of that federal aid package,” said Griffin.

Is the FAFSA hard to fill out?

“There is a bit of a fear around the FAFSA, but I will say I think a lot of that comes from the older versions,” said Griffin.

Griffin explained that the FAFSA has “evolved quite a bit” over the last decade or so, as the form used to be a lengthy paper document that was quite intimidating to high schoolers. Obviously, the first step was to put the FAFSA on the web, which has been done. For this 2019/2020 cycle of the FAFSA, there is also a mobile application option.

The application also has what Griffin referred to as “skip logic”, which means the application is only going to ask questions that you need to fill out and it will skip over questions that don’t pertain to you, as the computer knows to skip based on your previous answers, making the process shorter and easier. There is also the availability of an IRS data retrieval tool, that will pre-fill some financial tax information for you. This also applies to when you renew your application each academic year.

If you’re just getting started, here’s a checklist from Edvisors of what you’ll need to have with you to fill out the form:

- Your FSA ID

- Your social security number

- Your driver’s license number (if applicable)

- Your tax records for the previous year. For the 2019/2020 cycle, this means your 2017 tax records

- Records of your untaxed income (if applicable)

- Records of your assets

- List of schools/universities you are considering

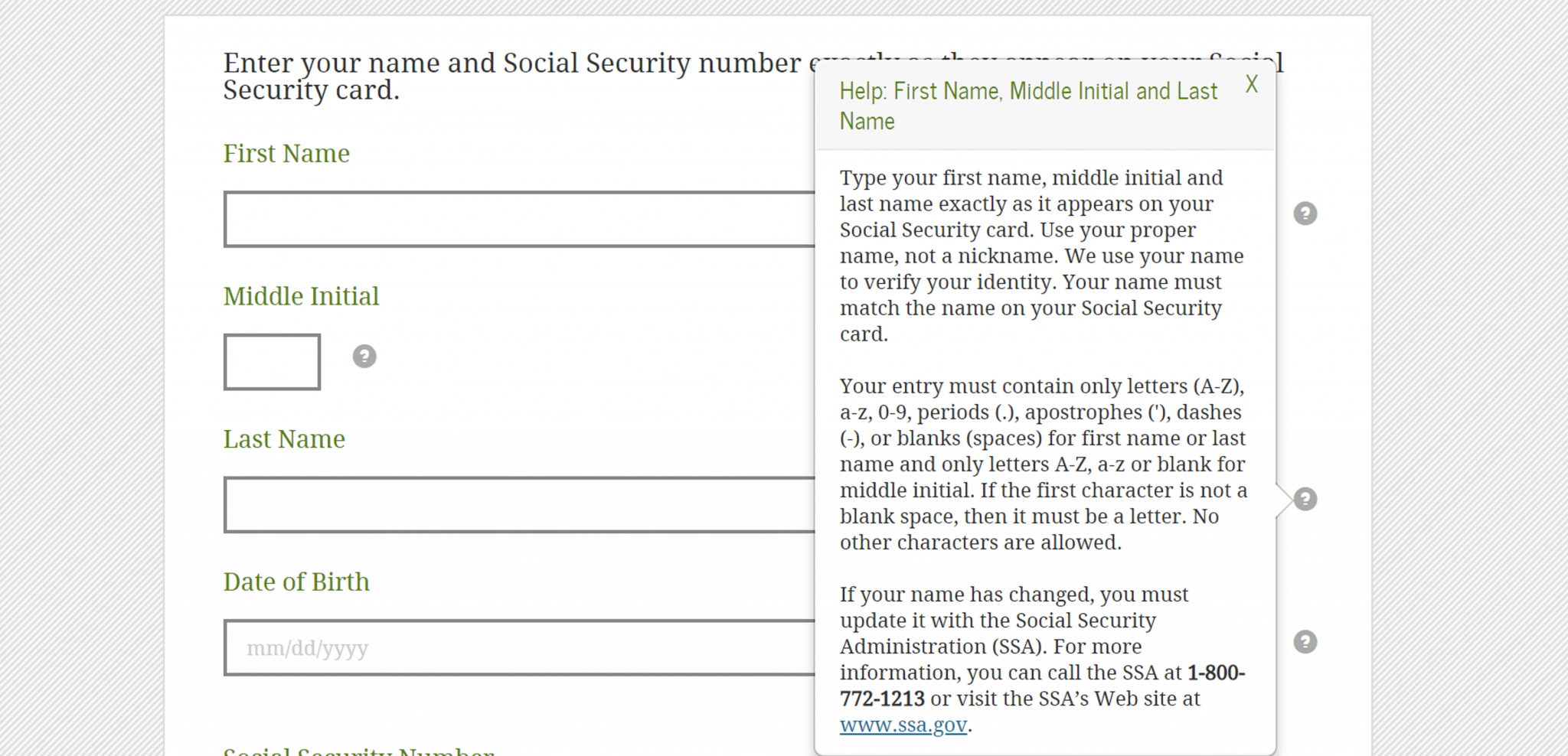

One thing Griffin said that students should keep in mind as you work through your application is that there are FAQ explanations build into the application. So if you’re confused on something, there will be a question mark icon either on the page or next to the question that will elaborate on questions and provide additional assistance.

Griffin added that one aspect of the form where sees students having a lot of questions is in the case of more than two parents. For example, if I student’s parents are divorced and the student has parents and step-parents. The confusion refers to which parent’s information is to be included, and if step-parents should be included.

“That sort of thing can be very confusing but there are ways to do it, there are a ton of resources out there,” said Griffin.

These resources can be the Department of Education, your high school guidance counselor, or companies like Griffin’s.

When should I turn in the FAFSA?

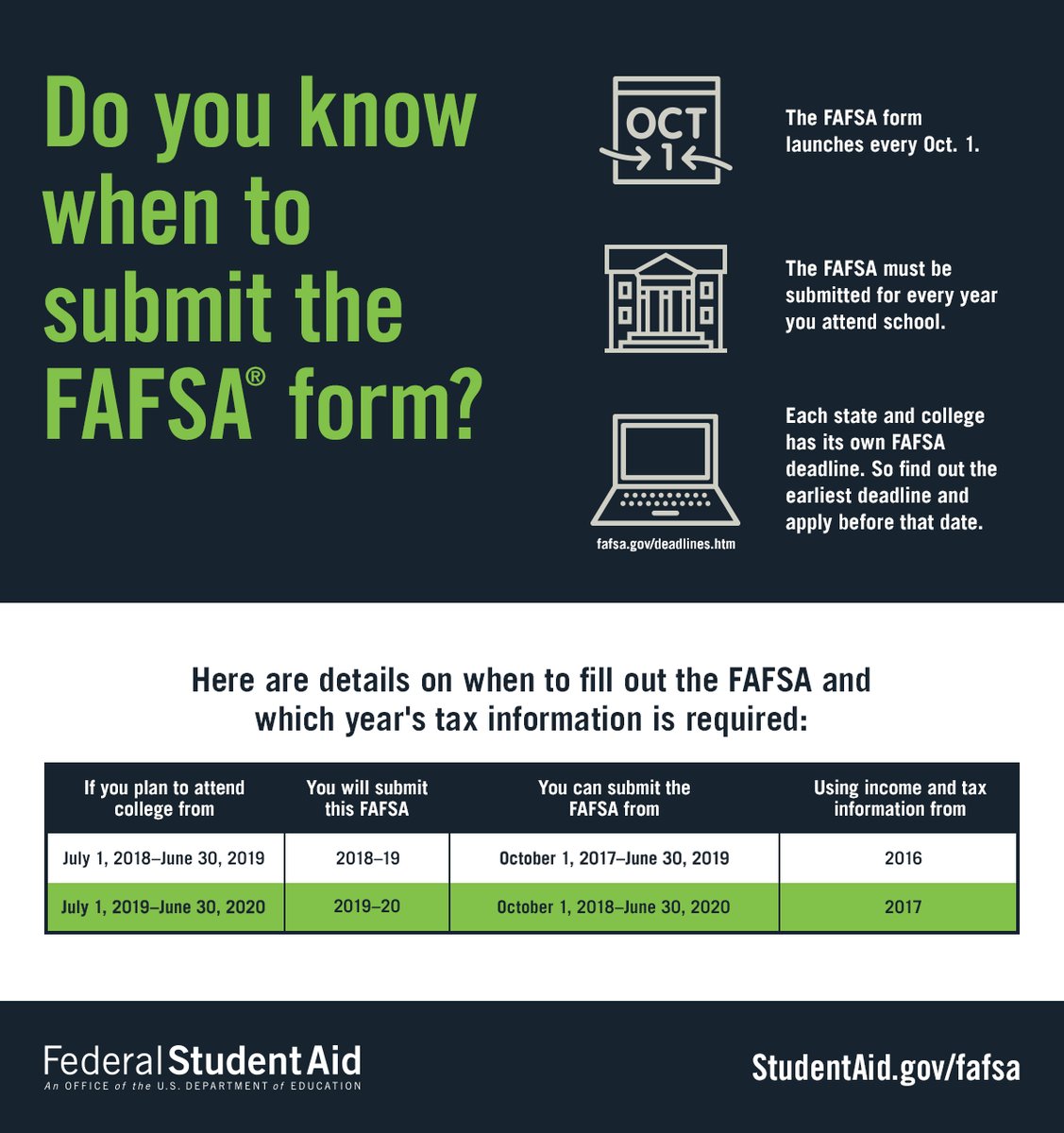

Although the FAFSA is technically open from October 1st 2018 to June 30th 2020 for the 2019/2020 cycle, Griffin recommends starting and getting it done as early as you can.

“We always say start early because that’s when you can work out through some of the issues that you have or questions that you have, and you can take a little bit of time to do it and still file relatively early,” said Griffin, who added that “some states will have first come, first serve aid available, so you want to get it in there quickly so that you can have your best chance of getting some state aid.”

This first come, first serve rule also applies to some universities.

“If you’re waiting until a deadline, say your school’s March 1st deadline, then you’re going to run into more trouble where you’re not going to have the time to work through some of those answers and it might send you into a panic,” said Griffin.

That being said, it is most important to make sure that the information you’ve supplied is correct.

“The number one thing is if you’re not exactly sure, then maybe don’t submit it right away. Take some time to figure out that answer because you don’t want to be providing any false information or run into problems,” said Griffin, as problems with conflicting information may need to be resolved later on at school, which is something you won’t want to deal with.

Overall, the FAFSA is supposed to be a helpful tool, and it’s is important to take the time to complete thoroughly and accurately. If you’re confused on anything, there are plenty of people who are well versed on the FAFSA either on or off your school campus that can help you, so don’t be afraid to ask.

See also: 529 Plans: The Best Way to Have a Stress-Free College Experience